Content

- Is Retained Earning a Temporary Account?

- What is a permanent account?

- Stay up to date on the latest accounting tips and training

- Unit 4: Completion of the Accounting Cycle

- Income Summary Account

- Previous PostAccounts Receivable or Payable on a Cash-Basis Balance Sheet?

- Permanent AccountsDefinition, Types, and Examples

There is no predetermined fiscal period to maintain a temporary account, but it usually lasts for a year or less. Quarterly temporary accounts are fairly common, especially when it comes to tax payments or measuring the company’s financial performance. In fact, these accounts make it easier for businesses to track the achievement of milestones.

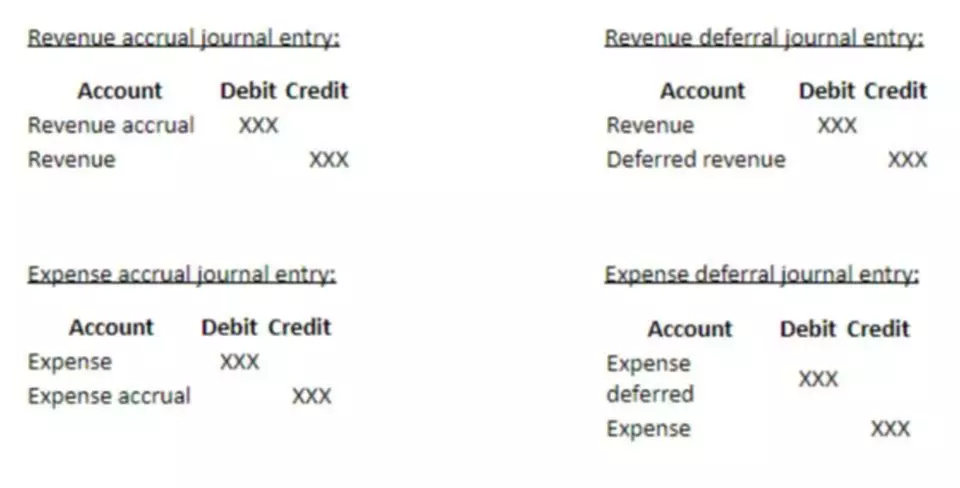

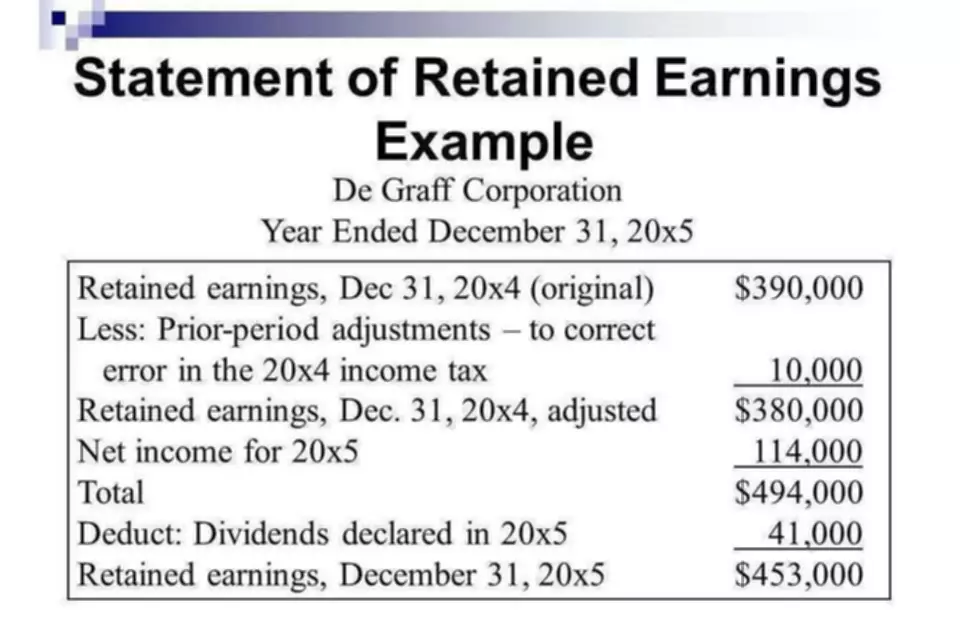

Just like in step 1, we will use Income Summary as the offset account but this time we will debit income summary. The total debit to income summary should match total expenses from the income statement. A company’s accounts are classified in several different ways. One way these accounts are classified is as temporary or permanent retained earnings accounts. Temporary accounts are company accounts whose balances are not carried over from one accounting period to another, but are closed, or transferred, to a permanent account. The income summary is used to transfer the balances of temporary accounts to retained earnings, which is a permanent account on the balance sheet.

Is Retained Earning a Temporary Account?

Don’t close your books at the conclusion of the fiscal year. If you’re a solo proprietor or your company is a partnership, you’ll need to shift activity from your drawing account for any excises received from the company. Mary Girsch-Bock is the expert on accounting software and payroll software for The Ascent. Because you did not close your balance at the end of 2021, your sales at the end of 2022 would appear to be $120,000 instead of $70,000 for 2022. The information featured in this article is based on our best estimates of pricing, package details, contract stipulations, and service available at the time of writing.

In reality, permanent accounts receive information from temporary accounts during the close process. For example, all revenue, cost of goods sold and expense accounts close to retained earnings, a permanent account.

What is a permanent account?

So, at the end of a fiscal period, accountants note the closing balance, but they don’t close out the account by zeroing it out. Consequently, when the next fiscal period begins, the account continues with the closing balance it had from the previous fiscal period. After this entry, your capital/retained earnings account balance would be $700. Journal entry to move expenses to the income summary account. Permanent accounts, on the other hand, have their balances carried forward for each accounting period. Closing these accounts helps to ensure that transactions that occurred in the current accounting period are not included in the following period. In accounting, a permanent account refers to a general ledger account that is not closed at the end of an accounting year.

- Account, delivery expense account, purchase account, etc., are the type of temporary accounts included under losses and gains.

- You have also not incurred any expenses yet for rent, electricity, cable, internet, gas or food.

- We will debit the revenue accounts and credit the Income Summary account.

Income summary account is a temporary account used to make closing entries. All temporary accounts must be reset to zero at the end of the accounting period. In this way, the balances are emptied into the income summary account.

Stay up to date on the latest accounting tips and training

The value of most permanent accounts will typically change after this date. The statement informs shareholders about the date of information, which provides insight into a company’s value at a given time. Knowing that the ultimate effect of closing the temporary accounts https://www.bookstime.com/ to RE transfers the net income or loss to the RE account, we can now better understand the account name in simple terms. The retained earnings account has the word retain for this account is meant to“retain”or keep all the prior earning from the company.

Trade debts: PQEPC seeks permanent exemption from application … – Business Recorder

Trade debts: PQEPC seeks permanent exemption from application ….

Posted: Fri, 23 Dec 2022 06:48:19 GMT [source]

What are your total expenses for rent, electricity, cable and internet, gas, and food for the current year? You have also not incurred any expenses yet for rent, electricity, cable, internet, gas or food. This means that the current balance of these accounts is zero, because they were closed on December 31, 2018, to complete the annual accounting period. If this amount is accurate, you’ll then close Income Summary and transfer the balance to permanent accounts.

Unit 4: Completion of the Accounting Cycle

Temporary accounts in accounting refer to accounts you close at the end of each period. All income statement accounts are considered temporary accounts. These accounts include cash accounts, furniture accounts, inventory accounts, and more. Moreover, contra-asset accounts, including Accumulated Depreciation, Allowance for Bad Debts, are also examples of permanent accounts. All temporary account transactions are confined to the current fiscal year.