Contents

You can manually find out the virgin CPR stocks or can take the help of thisVirgin CPR scannerofchartinkto save your time. CPR provides the traders with the necessary advantage of predicting the trend, to make the profiting move. In this case, the trader has to look for opportunities to buy, and the TC level functions as a support line.

A pivot point is a technical analysis indicator used to determine support and resistance. Central Pivot Range as mentioned https://1investing.in/ above is a tool for technical analysis. Traders use it in intraday trading as an efficient trading indicator.

We are certified stock broker review & comparison website working with multiple partners. The CPR lines indicate a bullish outlook if they constantly move upward and the price remains higher than the TC value. Central Pivotal Range or CPR is one of the well know Intraday Indicators used by technical analyst in their day to day work life. If you are subscribing to an IPO, there is no need to issue a cheque. Please write the Bank account number and sign the IPO application form to authorize your bank to make payment in case of allotment. In case of non allotment the funds will remain in your bank account.

Trading above or below the pivot level signifies the overall market sentiment. It is a leading indicator offering superior signaling of probably new market highs or lows within a given timeframe. A pivot level is a technical evaluation indicator used to find out the general trend of the market throughout completely different time frames. It helps forecast where assist and resistance might develop in the course of the day. The different levels in the pivot point can help you detect the points where the price of that stock could face support or resistance.

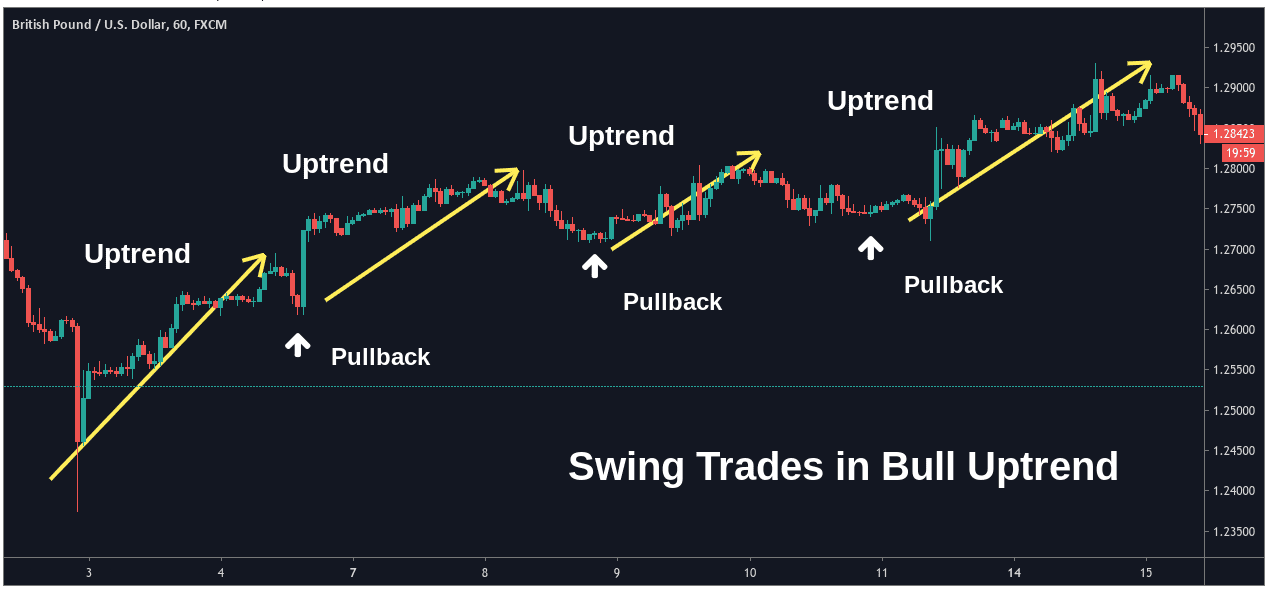

The direction of the price movement can also be detected when the price moves through some of these levels. There are a variety of formulas you can use to find out the pivot levels. A pivot point that also overlaps or converges with a 50-interval or 200-interval moving average, or Fibonacci extension level, becomes a stronger assist/resistance level. These are mainly mini ranges between the main pivot point and support and resistance ranges.

A CPR chart allows traders to technically analyze the market in different ways. The 3 levels of CPR are calculated based on the prices of the preceding period. It is to help the traders foresee the movements in stock price and invest accordingly to gain profits. When the current price is trading between the CPR lines, it indicates an accumulation phase and a sideways market. Traders can wait for a CPR breakout above TC with the volume in such a case. Another option is to buy at the bottom central pivot point keeping the target top central pivot point which can be done in case of wide CPR.

How do you make a pivot point?

The highest value of the three values, regardless of how they are calculated, is usually referred to as TC, and BC is the lowest. In this strategy first we need to find out someVirgin CPR stocks. Without knowing virgin CPR you won’t be able to implement this strategy. Top10stockbroker.com & Indianfranchisereview.com are websites under Medmonx Enterprises Private Limited.

In this pivot trading technique I will embody the Moving Average Convergence Divergence indicator. The point of this technique is to match a pivot level breakout or bounce with a MACD crossover or divergence. When you match signals from both indicators, you should enter the market in the respective path. A stop loss must be used in this trading strategy the same way as with the earlier technique. Pivots Points are important ranges chartists can use to determine directional movement and potential assist/resistance levels.

The second methodology is to make use of pivot point price levels to enter and exit the markets. Like modern-period day merchants, ground merchants dealt in a very fast moving environment with a short-term focus. At the start of the buying and selling day, how to calculate central pivot range ground traders would take a look at the day past’s high, low and near calculate a Pivot Point for the present trading day. With this Pivot Point as the base, further calculations have been used to set support 1, support 2, resistance 1, and resistance 2.

Central Pivot Range indicator is used to identify key points of price levels and trade accordingly. Traders can take up trading positions based on the different levels on the chart. It is quite popular among traders as it is quite versatile and simple to understand. These levels are pivot points, top central pivot point, and bottom central pivot point.

How to Use Pivot Points for Intraday Trading?

If the price touches a pivot point from above and reverses thereby, that’s when an asset is bought. On the other hand, if it tests the point from below and bounces off downward, that’s when a trader sells. With CPR, you can look for breakout trades when the price breaks below BC or Above TC with high volume confirmation. The wide CPR is difficult to break through, hence acts as solid support or resistance. You can trade this by waiting for a breakout above TC with volume, or in case of wide CPR, you can buy at BC and keep target TC and sell at TC by keeping target BC. Some people love to trade at a sideways market, and price within the CPR is an Indication of a sideways market, or we can say an accumulation phase.

It happens according to its width, breakouts, support and resistance levels, virgin CPR, overall trend, etc. to study the price movements and continue the trade. Such technical analysis of the stocks can be done using various tools and techniques. John Person’s A Complete Guide to Technical Trading Tactics has a whole chapter dedicated to buying and selling with Standard Pivot Points. Person exhibits chartists the way to incorporate Pivot Point assist and resistance levels with other features of technical evaluation to generate purchase and promote indicators. The chart below shows the Nasdaq a hundred ETF with Standard Pivot points on a 15-minute chart.

- A stop loss must be used in this trading strategy the same way as with the earlier technique.

- The wide CPR is difficult to break through, hence acts as solid support or resistance.

- The different levels in the pivot point can help you detect the points where the price of that stock could face support or resistance.

- You can also use our CPR calculator to calculate the CPR along with other important floor and camarilla pivot points.

- Traders can wait for a CPR breakout above TC with the volume in such a case.

This is on account of this indicator being quite simple to understand and follow. It will take away the subjectivity concerned with manually plotting help and resistance ranges. Pivot Points have been initially utilized by flooring traders to set key ranges. For intraday traders, figuring out when to exit their trades is a constant point of worry. Traders most often leave too early and regret it, or stay too long and face losses that were avoidable.

For example, a trader would possibly put in a limit order to purchase one hundred shares if the worth breaks a resistance level. Alternatively, a dealer might set a stop loss at or close to a help level. Notice that the pivot levels of every buying and selling day are lined in another way. This is so, as a result of each buying and selling day has totally different day by day high, low and close values. We present content material for over one hundred,000+ active followers and over 2,500+ members.

Pivot Point Indicator

I have also writtenhow to add CPR Indicator and Floor Pivots in Zerodha kite, kindly read it once again if you face any problem to plot this on your chart. The three different levels within the CPR can be used effectively as the stop loss. As per this calculation, the highest value is often the TC value and the lowest is that of BC. Trading in “Options” based on recommendations from unauthorised / unregistered investmentadvisors and influencers.

Email and mobile number is mandatory and you must provide the same to your broker for updation in Exchange records. You must immediately take up the matter with Stock Broker/Exchange if you are not receiving the messages from Exchange/Depositories regularly. Update your e-mail and phone number with your stock broker/depository participant and receive OTP directly from depository on your e-mail and/or mobile number to create pledge. The system trades the value moving towards—and then bouncing off of—any of the total or halfway pivot points. Any Grievances related the aforesaid brokerage scheme will not be entertained on exchange platform. Please note that by submitting the above mentioned details, you are authorizing us to Call/SMS you even though you may be registered under DND.

How do you trade in a pivot?

The CPR width is the distance between the TC and the BC lines of their CPR indicator. A narrow CPR width is when the distance between the TC and BC is relatively small. When the distance between TC and BC is quite huge, it is a wide CPR width and indicates a sideways market. A medium CPR width is when the distance between TC and BC is between the narrow and wide margins of CPR. Pivot points are based on a simple calculation, and while they work for some traders, others may not find them useful.

The pivot point itself represents a stage of highest resistance or support, depending on the overall market condition. You should keep within the commerce till the MACD supplies an opposite crossover. Firstly, I will present you tips on how to use pivot factors as part of a pure price motion trading strategy, without the assistance of any additional trading indicator. If we enter the market on a breakout, we will put a stop loss under the earlier pivot level.